Beware of Financial Fraud & Ponzi Schemes: Too Good To Be True – Truth or Fiction?

April 14, 2021

By: Bernard Vogel III

Recent news headlines should remind investors about the dangers of “get-rich- quick” Ponzi Fraud Schemes.1 Such financial disasters exemplify the necessity of prudent and diligent verification before considering what are likely to be “too good to be true” investment opportunities.

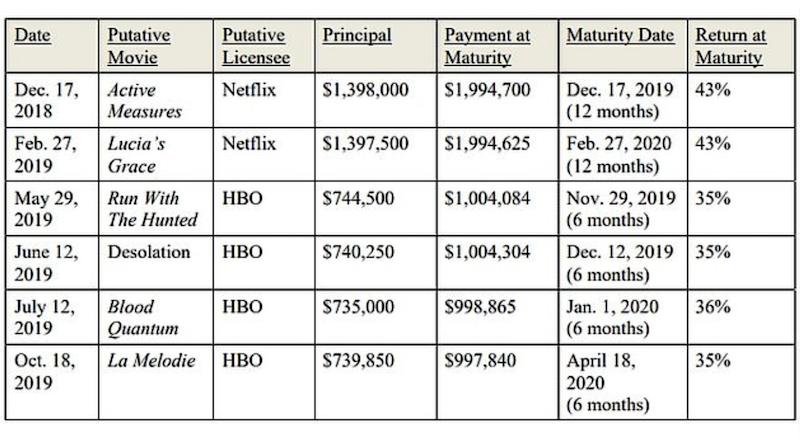

The Los Angeles Times recently reported that small-time actor Zachary Horwitz, AKA stage name Zach Avery, was indicted for raising more than $690,000,000 in short-term, high-yield loans over five (5) years in a massive Ponzi scheme. In his indictment, the FBI alleges Horwitz has defrauded investors out of $227 million; falsely claiming to investors that his 1inMM Capital LLC owned movie licensing deals with HBO on Netflix to distribute the films in Africa, South America, Australia, and New Zealand. The movie specific loans were for 6 to 12 months, yielding 35% to 43%, depending upon the movie as reported in the Los Angeles Times.

Below is a picture of examples of Promissory Notes, Horwitz offered to investors:

The San Diego Union Tribune reported that disgraced San Diego-based The Patio Group founder, Gina Champion-Cain was recently sentenced to 15 years in prison for her masterminding of a $300 million “egregious securities fraud” against 100 investors. See U.S. Southern District Sentencing Press Release. According to the Securities Exchange Commission complaint, Champion-Cain and her ANI Development, LLC raised hundreds of millions of dollars from investors by offering an opportunity to make short-term, high interest loans to parties seeking to acquire illusory California alcohol licenses. The court-appointed receiver estimated approximately 349 investors in the liquor license lending scheme lost approximately $183 million.

Both of these alleged safe and phenomenal investment opportunities had all of the indices of Ponzi scheme2, as well as many other securities fraud characteristics which should have raised red flags to both investors and their counsel. The below dubious characteristics of the investment opportunities should have heightened the need for, and the scope of, due diligence investigations and verifications.

What is a Ponzi scheme? A Ponzi Scheme is a form of fraud in which belief in the success of a nonexistent enterprise is fostered by the payment of quick returns to the first investors from the money invested by the later investors.3

Indices of Ponzi scheme. According to the Securities and Exchange Commission (SEC), many Ponzi schemes share similar characteristics that should be “red flags” for investors. Some of the warning signs were:

- High investment returns with little or no risk. Every investment carries some degree of risk, and investments yielding higher returns typically involve more risk. Any “guaranteed” investment opportunity is often considered suspicious. Both schemes involved short-term loans of one year or less and promised hi yields. Horwitz promised “solid returns and safe investments.”

- Overly consistent returns. Investment values tend to go up and down over time, especially those offering potentially high returns. An investment that continues to generate regular positive returns regardless of overall market conditions is considered suspicious. Both schemes offered alleged low risk investments. Champion-Cain offered 15% – 25% return. Horwitz promised 35% to 43% returns. How many legitimate investments can promise those returns?

- Unregistered investments. Ponzi schemes typically involve investments that have not been registered with the SEC or with state regulators. Registration is important because it provides investors with access to key information about the company’s management, products, services, and finances. Although loans of this kind constitute securities, most investors would be unaware of the need for SEC and Blue-Sky law registrations or exemptions.

- Unlicensed sellers. Federal and state securities laws require that investment professionals and their firms be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms, the few exceptions usually being the aforementioned investment vehicles that started out as legitimate operations but failed to earn the expected returns. Both masterminds were not registered or licensed. Given their acting and restauranteur backgrounds they lacked investment expertise.

- Secretive or complex strategies. Investments that cannot be understood or do not give complete information. Foreign movie distribution rights with large corporations, such as HBO and Netflix, and the regulatory issuance process of alcohol licenses would be difficult to verify by unsophisticated lay investors. Champion-Cain instructed investors never to contact the escrow company to inquire about their investments, a “red flag” in and of self.

- Issues with paperwork. Excuses are given regarding why clients cannot review information in writing about an investment. Also, account statement errors and inconsistencies are frequent signs that funds are not being invested as promised. Although not stated in the press releases, it is likely that the fraudsters represented that HBO and Netflix would not respond to inquiries, and the State of California would not be willing to verify the movie rights and issuance of alcohol licenses.

- Difficulty receiving payments. Clients have failures to receive a payment or have difficulty cashing out their investments. Ponzi scheme swindler routinely encourage participants to “roll over” investments and sometimes promise even higher returns on the amount rolled over. Horwitz fabricated fake HBO and Netflix executive emails to justify delayed payments to investors. Champion-Cain sent a doctored escrow company email to her investor with the intent to allay any concerns about the safety of the investor’s funds and conceal her fraud.

Security Fraud Characteristics. Both security fraud schemes had questionable characteristics which indicated a riskier investment opportunity and should have prompted a greater need for investigations, verifications, and due diligence procedures:

- Both investment entities were single-member LLCs. Members are owners of a limited liability company. Generally, the lack of multiple owners reduces checks and balances or supervision by other owners.

- Both investment entities were single manager managed LLCs. Although an LLC may be managed solely by its owner, LLCs can have presidents, CFOs, etc. The sole manager structure again indicates a lack of governance oversight, checks and balances, supervision, and liability for multiple responsible parties.

- LLCs by their very nature tend to lend themselves to a less structured, less formal organization.

- Unlike stock investments, loans to an investment entity frequently do not come with voting rights, inspection rights, rights to inspect owner records, and delivery of financial statements.

- Both fraudsters did not appear to have any core expertise in the investment activity, such as lending and financing expertise or movie distribution experience. Champion-Cain was a restaurateur brokering the financing of California alcohol licenses, and Horwitz was a 34-year-old small-time actor running a bogus foreign film licensing and distribution company.

- Both investment opportunities offered quick short-term unsecured loans financing acquisitions of personal property. Sophisticated lenders often times require a security interest in the personal property they are financing.

- Both offered high yield returns beyond those generally available in the marketplace.

- Both investment entities lacked oversight supervision of an investor committee. Lenders tend to invest separately, view themselves independent of other creditors, and do not work together to oversee their investment security.

- Lender/investors did not receive monthly financial statements or reports and did not receive Audited Financial Statements. The mistaken assumption was the lack of need for verified financial monitoring for such 6 to 12 months loan.

- No escrow services were used to verify and ensure that the investment funds were used properly. However, according to the SEC Complaint against Champion- Cain, the major investor drafted an escrow agreement to be executed by ANI Development and its escrow company, providing the money could only be used for specified investments and for no other purpose. Unfortunately for the major investor did not have direct negotiations with the escrow company, and Champion-Cain and her ANI Development had unfettered control over the funds.

Ponzi scheme organizers often promise high returns with little or no risk and use money from new investors to pay earlier investors. They often steal some of the money for themselves. Zachary Horowitz purchased a $5.5 million home, spent hundred thousand dollars on Las Vegas trips and paid off a $1.8 million American Express bill. Champion-Cain directed significant amounts of investor funds to companies she controlled, as well as to herself and family members, and approximately 40 other businesses, including restaurants, rental properties, coffee shops and a surfing supply store.

A disturbing characteristic in the Horwitz Ponzi scheme was the gross negligent involvement of newly formed investment funds and fund advisory companies whose founders and managing partners had very limited financial experience and success.

- According to Nathan Vardy, Senior Editor at Forbes, a Chicago-based investment firm JJMT Capital, LLC, whose name was the first initials of its founders, Jake Wunderlin, Joe deAlteris, Matthew Schwinzger, and Tyler Crookston, may have lost $160,000,000 in principal and another $59 million in lost interest. With the exception of Tyler Crookston, all attended Indiana University around 2010, struck up a close relationship with Zachary Horwitz, and had previously had “low-level entry jobs” at J.P. Morgan and Morgan Stanley.

- Other reported Horwitz investors included Movie Fund, Fortune Film Fund One, Fortune Film Fund Two, SAC Advisory Group, Vausse Films and Pure Health Enterprises. Fortune Film Fund One, Fortune Film Fund Two, and SAC Advisory Group had a very young fund manager with very little sophistication or financial experience.

Avoiding Ponzi schemes. In addition to greed, one of the attractive lures of a Ponzi scheme is that the publicity from the seemingly successful initial investment activity seduces later investors due to validating high return to the initial investors. Many investors are attracted to the Ponzi scheme by their colleagues’ or friends’ boastful praises of the payoff of the exorbitant returns.4 When it becomes hard to attract new additional later investors, or when large numbers of existing investors cash out, Ponzi schemes tend to collapse.5 And then it is too late.6 Moreover, if the fraudsters of a Ponzi scheme are facing the likelihood of imminent collapse and criminal charges, they may see little additional “risk” to themselves in attempting cover their tracks by engaging in further illegal acts, sending fake emails, and doctoring documentation, lies, and raising additional Ponzi funds.

In order to avoid Ponzi schemes a disciplined review by legal and investment advisors would mitigate and prevent the risk of an investor being a victim of a Ponzi scheme collapse. Below are some lessons to be learned from these two Ponzi schemes.

- Investment decision-making needs to be verified and methodical. Emails and text communications have accelerated decision-making and have facilitated the creation of a boiler room7 pressure environment for fraudsters to promote victims’ overreliance on the validity of such communications.

- Digital communications, PowerPoint presentations, PDF images, and other software can easily create the image of a viable business and credibility.

- PDF editing software, external document signing software, and other image editing software can modify documents and provide false verifying evidence. Frequently, analog communications, although not foolproof, provide a greater source of credible due diligence investigations then manipulable digital records.

- Similar to spam emails and phishing emails, ghost domain servers, and ghost email accounts can be used create fictitious communications .

- Investment funds should be escrowed with an escrow company, and escrow agreements should be negotiated directly with the escrow company.

- Review and analysis of the previous 12 months audited financial statements.

- If the investment is short-term, monthly financial statements should be regularly monitored, analyzed, and reviewed, and investors should have a personal and independent right to directly verify investment transactions.

- Loans to an investment entity are “securities” and are very risky investments, notwithstanding the fraudster’s assurances of safety.

- Third-party verification of banking relationships.

- Independent negotiations with the attorneys of promoters.

- Independent investigation of industry relationships.

- Conduct litigation and lien searches on promoters and the investment entity.

- Use your legal and investment advisors to not only perform due diligence but to independent observe the tone, demeanor, and disposition of promoter.

- Do not rely on solely on a single verification, but rather conduct multiple inquiries for consistency of story and facts. Pathological liars are known to be able to maintain consistently fraudulent stories within their community of relationships.

1 Also, news stories recently reported the death of one of the most infamous Ponzi scheme swindlers, Bernie Madoff on April 13, 2021

2 Ponzi schemes are named after Charles Ponzi. In the 1920s, Ponzi promised investors a 50% return within a few months for what he claimed was an investment in international mail coupons. Ponzi used funds from new investors to pay fake “returns” to earlier investors.

3 Oxford English Dictionary [emphasis added].

4 The first investor in the Champion-Cain scheme brought in other investors who invested an additional $50,000,000 in the liquor license Ponzi scheme.

5 The collapse is often caused by a run on the market, economic recession, sharp decline in the economy, panic, a whistleblower, news related to the investment activity, or the promoter fraudster vanishing and absconding with the funds.

6 Especially with lightly regulated investment activities, in the absence of a whistleblower and/or accompanying illegal acts, any fraudulent content in reports is often difficult to detect unless and until the investment vehicles ultimately collapse.

7 The term “boiler room” refers to an operation using high pressure sales tactics to induce the sale of stocks, other securities, or commodities.